Nairobi, August 2025 — Kenya’s consumer market is standing at a defining moment. The latest NielsenIQ East Africa Consumer Outlook reveals an economy in recovery, yet shaped by cautious spending, shifting brand loyalties, and the accelerating influence of digital platforms. Combined with perspectives from leading marketing, retail, and sustainability professionals, the report offers a detailed view of where opportunities lie—and how brands must adapt to capture them.

Growth Outpacing the Region, But Mindsets Remain Guarded

Kenya’s GDP growth continues to exceed the Sub-Saharan Africa average, with East Africa leading continental expansion. FMCG value growth stands at 11%, driven largely by inflation, while modest increases in volumes suggest consumers are slowly returning to the market. Still, 91% of Kenyans believe the country is in a recession—a perception shaping purchasing behaviour across all generations.

Gen X, feeling the pressure most, is focusing on essentials and bulk purchases. Millennials are highly responsive to promotions, while Gen Z continues to shape new consumption patterns. Across the board, rising food prices, economic uncertainty, and job security dominate concerns in 2025.

Evolving Spending, Saving, and Brand Loyalty

Households are allocating more towards core needs such as education, healthcare, and groceries, while cutting back on discretionary categories like entertainment, electronics, and dining out. Brand loyalty is under strain—two-thirds of consumers switched brands in the past year, with staple goods such as cooking oil, laundry products, and milk leading the shift. Quality and trust remain the strongest loyalty drivers, particularly for Millennials and Gen X.

Savings behaviours are changing as well. Banks remain the preferred savings channel, but mobile app–based savings tools are growing rapidly among Gen Z, marking a clear pivot to digital-first personal finance.

Digital Commerce and the Social Media Effect

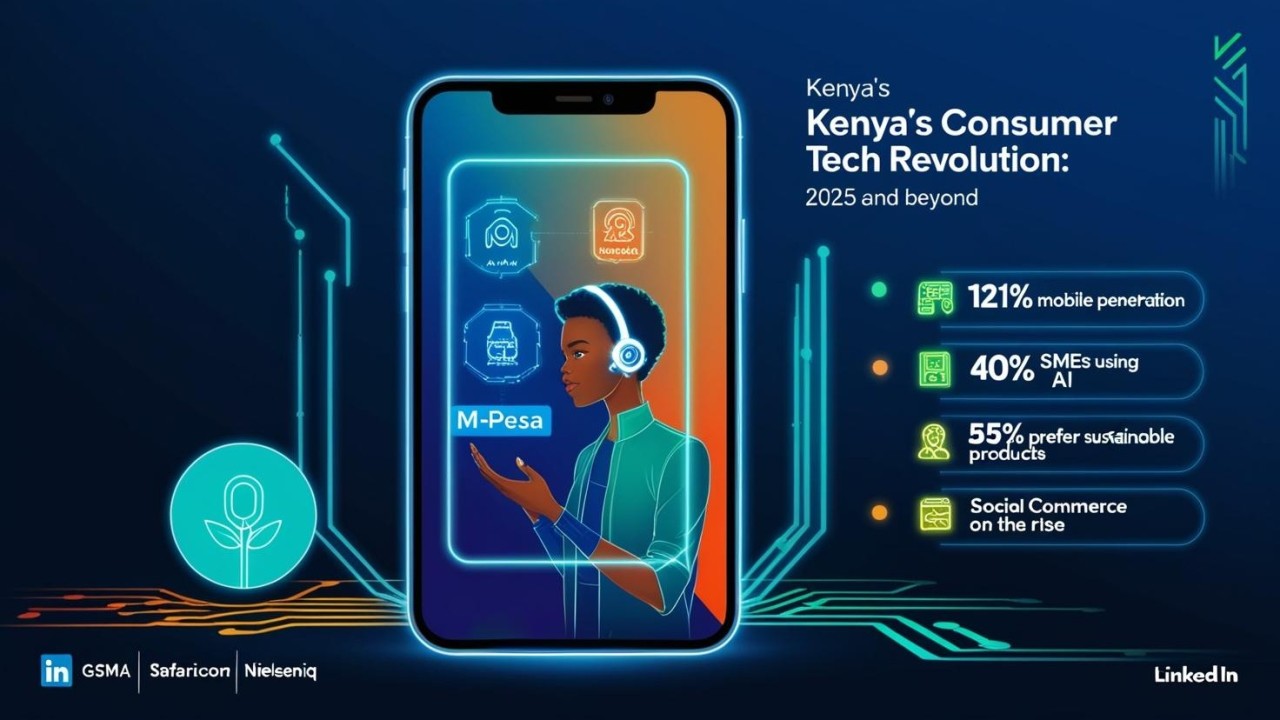

Social media is reshaping the purchase journey. Twenty percent of Kenyans say their buying decisions are influenced by social platforms—TikTok in particular, which resonates strongly with younger demographics. Clothing and electronics dominate social commerce purchases. Meanwhile, 35% of Kenyans now shop online, although uptake among older generations remains limited.

Artificial Intelligence is beginning to play a role in the shopping process, with 11%—primarily younger consumers—using AI tools to compare prices and gather product details.

Retail Channels and the Local Advantage

Traditional trade still accounts for more than 60% of FMCG volumes, but modern supermarkets are winning ground among younger shoppers. A significant 89% of consumers now prefer local brands over international options, signalling that even global companies must adapt their offerings to the local market.

Sustainability Moves to the Forefront

With 71% of Kenyans prioritising environmentally responsible and socially conscious brands, sustainability has shifted from a trend to a core market expectation. Products that combine high performance with eco-friendly attributes are set to capture greater consumer loyalty.

Voices Driving the Market Forward

The NielsenIQ panel highlighted leaders shaping East Africa’s evolving consumer environment:

- Prudence Mutembei — Senior Brand Manager, Beers at KWAL (Heineken Beverages), steering Heineken’s bold re-entry into Kenya with a focus on youthful, dynamic consumers.

- Francis Karugah — Vice President at IndaHash, redefining brand–consumer connections through large-scale influencer marketing.

- Willy Kimani — Founder of Jaza Discounter, driving retail transformation through operational innovation and global best practices.

- Valyne Kinya — Communications Officer at EPROK, leading campaigns for responsible e-waste management and circular economy awareness.

Winning in 2025: The Strategic Blueprint

To thrive in this competitive landscape, brands must:

- Maintain uncompromising quality while remaining competitive on price.

- Leverage social commerce and influencer networks to reach younger consumers.

- Embed sustainability into product development and brand storytelling.

- Integrate traditional and modern retail strategies for maximum reach.

- Harness AI and digital tools to deliver value and enhance the shopping experience.

Kenya’s consumer market in 2025 blends caution with possibility. For brands prepared to innovate, localise, and lead with trust, the rewards will extend beyond growth—towards lasting market leadership.